Stock Market Nosedive Doesn’t Bother the CIA

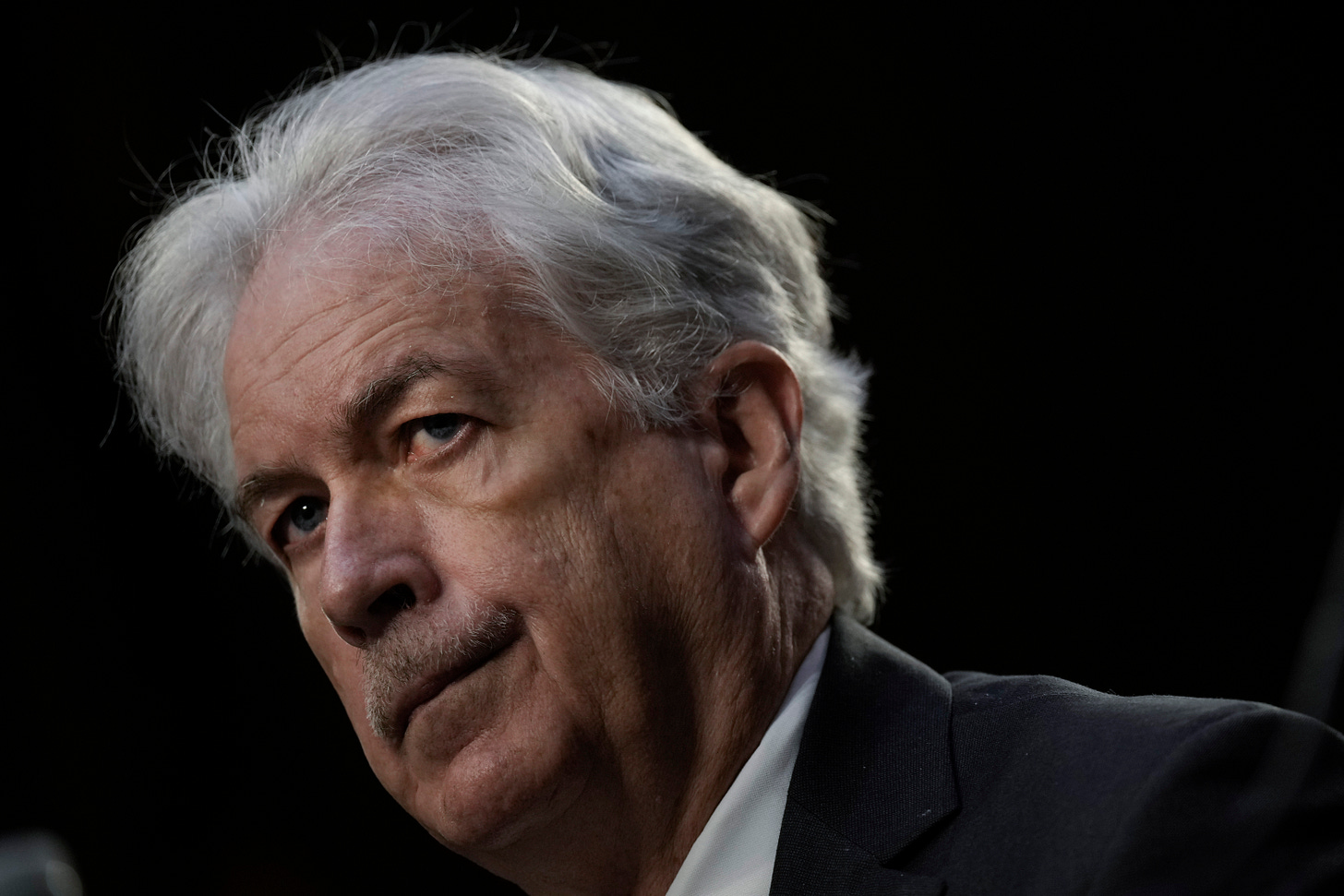

Here’s what former director Bill Burns knows that we don’t.

Outgoing CIA Director William Burns has a secret. He is betting big on America. Yet even with the stock market plunging, the joke’s on us.

Publicly, Burns fulfilled one of the responsibilities of any top intelligence official: scaremongering about a fragile America besieged by unseen forces, from terrorism to TikTok. But in private, he is bullish on America. His investments show this, armed, one presumes, with the best information and insight on the state of the world. And Burns knows Trump, his plans on Ukraine and the Middle East and his propensity to use tariffs to bully countries around the world.

Fear, it seems, is for the little people, who must assent to forever swelling national security budgets, always to stave off the latest supposed crisis.

We’ve obtained a copy of Burns’ official financial disclosure, which he was required to file in January upon leaving his job. He’s firmly invested in America, the disclosure reveals, with only scant investments (proportionally speaking) in foreign markets.

As a seasoned career diplomat (a first for a CIA Director) and as Biden’s highly regarded global troubleshooter, Burns would be first to know about foreign opportunities for investment. Yet his portfolio is most heavily concentrated in the United States (and equity markets), according to an Office of Government Ethics disclosure he signed on January 14.

With the exception of just a couple investments (one in a “EuroPacific” fund), Burns is pot-committed to the United States and its continued vitality. These are his largest mutual fund holdings (each with more than $250,000 invested):

American Funds New World Fund, Inc Class F2 Shares (NFFFX).

T Rowe Price Retirement 2030 Fund (TRRCX).

Vanguard Dividend Appreciation Index Fund ETF Class Shares (VIG).

Vanguard Small-Cap Value Index Fund ETF Class Shares (VBR) (purchased while CIA director).

T Rowe Price Dividend Growth Fund (PRDGX).

Permanent Portfolio Class I Shares (PRPFX) (purchased while CIA director).

Within Burns’ IRA fund (T Rowe Price Retirement 2030 Fund), international stocks and bonds represent only about 29 percent of the total. But that’s about the only significant foreign investments he has.

Within Burns’ other funds, the biggest holdings in American stocks include many of the blue chip stocks people think of when they think of the American stock market:

Apple

Broadcom

Chubb

Costco

Exxon Mobil

GE

JP Morgan Chase

Mastercard

Meta (Facebook)

Microsoft

Nvidia

Palantir

UnitedHealth Group

Visa

Walmart

Burns is no fool, standing out in the Biden administration’s army of empty suits as a figure almost uniquely respected by foreign leaders, which is why he became the shadow Secretary of State. In theory, he made his investments with the benefit of being privy to all the secrets of the country’s premier spy agency. Whatever his public role of scaring the shit out of the public (about the rise of China, Russia, Iran, ISIS-K, take your pick) none of the supposedly dire picture scares him from personally investing in the red, white and blue.

There’s an important point here — aside from the funniness and schadenfreude of a rich Washingtonian watching his investments tank this week. (Call that an intelligence failure?) Burns’ holdings show his fundamental confidence in America’s economic outlook.

None of that stops the fear mongering of the national security state, that without more of our tax dollars, America will continue its supposed decline. National security officialdom is happy to sound the alarm about China, Russia, Iran, North Korea, terrorism, domestic extremism, disinformation, and so on, not because they threaten to fundamentally alter the outlook of the country or its future, but because that’s how these agencies get their funding.

Meanwhile on Wall Street today, Broadcom, GE, Meta, Microsoft, Nvidia, Palantir, and United HealthCare all tried to claw their way back into the green.

The house always wins.

*I feel compelled to add: Past performance is no guarantee of future results. General economic factors that are beyond KLIPNEWS’ control impact these forecasts and actual performance. These factors include interest rates; recession; inflation; deflation; consumer credit availability; consumer debt levels; tax rates and policy; unemployment trends; the threat or possibility of war, terrorism or other global or national unrest; political or financial instability; climate change; pandemic and other matters that influence consumer confidence and spending. Increasing volatility in financial markets may cause these factors to change with a greater degree of frequency and magnitude.

— Edited by William M. Arkin

Ok but does he have stock in TSLA because that shit is going to fucking crater (if I have anything to do with it)

Great sleuthing on Burns portfolio. GO KLIPPENSTEIN!!